IBM Instana dashboard

IBM

There are two ways to answer the question posed in the headline. The simple answer is yes, IBM has continued to invest in acquisitions including HashiCorp and DataStax, leading to a more robust portfolio of products for enterprise IT shops. But, after attending IBM’s Think conference in 2024, I walked away with concerns about this emerging portfolio of software. In particular, it seemed that IBM was struggling to develop an integrated product and go-to-market strategy. I was left scratching my head in terms of what advice I could give customers on how to engage with IBM and get some joint value out of these related but different solutions. Heading into last week’s Think 2025, I wanted to be convinced that things were different despite more acquisitions.

For the most part, I got what I was hoping for.

(Note: IBM is an advisory client of my firm, Moor Insights & Strategy.)

Three Notable Changes In IBM’s Strategy

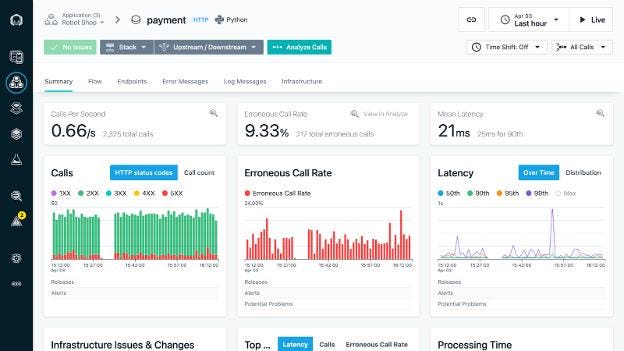

Last year I didn’t think that IBM’s software wasn’t good or that it was lacking features. My concern was that IBM did not have a clear message about what made a number of point-products better together. For example, why would a longtime Apptio (IBM) customer consider switching to Instana (IBM) when they were perfectly happy with Instana competitor Dynatrace? Additionally, at Think last year IBM announced a new product called Concert that sounded kind of like Instana in some ways. So even if I did not already use a competing product, which IBM product should I buy?

This year was quite different, and IBM was very clear about what it needed to change and what it ended up doing.

IBM kept its focus on its core customer — This is easier said than done in the context of technology acquisitions. There is a lot of pressure to justify the acquisition of a company, so it’s easy for a team to dilute its focus in service of short-term revenue performance or possibly at the risk of alienating pre-acquisition customers. By contrast, over the past year IBM has added features and capabilities that genuinely serve large enterprises. For example, simplifying compliance audits in regulated industries may not be on the top of everyone’s list of desired new features, but for many IBM customers it’s quite relevant. Also, IBM realized that some of its product teams needed more prescriptive missions; this was the case with Concert, which is now focused on end-to-end application resilience rather than a broader set of observability goals.

Hybrid, hybrid, hybrid — The cornerstone of IBM’s strategy is hybrid computing, and the IBM IT Automation portfolio is designed to span any cloud or on-premises footprint. This tends to align better to large enterprises that have complex and heterogeneous environments. But it’s also a reflection of the competitive landscape. The IT automation environment is loaded with either point-solutions or embedded solutions from the various hyperascalers. Both of these options tend to be lower-cost but also come with their own challenges. Unless you are all-in on one cloud or have a team that can weave together multiple tools, you might be drawn to IBM’s end-to-end automation solution that spans any deployment.

Embedded AI agency — From a technology perspective, a key goal is making the acquired products work better together and provide a meaningful cross-product experience. IBM’s approach to this is to use AI and agents, which ends up providing a richer cross-product experience. For example, within the Instana interface, users are provided a more complete diagnosis of an issue based on information from other products — such as Concert for known CVE issues or Cloudability to optimize costs. The agents also work together to provide contextual recommendations. Once the operator decides which recommendations to accept, agents may launch tickets in ServiceNow to execute the recommendation. (I saw a demo of this specific integration at Think 2025, and it was impressive.) IBM is discovering that AI is a very effective way to integrate products and relevant data to solve complex problems and speed up implementation.

Great Progress, But It May Not Be For Everyone

I walked away from Think 2025 feeling much better than the previous year. But, I also think that for anyone evaluating IBM’s IT Automation software, all factors need to be considered. Three of these stand out to me.

Shift in mindset — As we all look forward, we need to consider that AI will significantly increase both the number and complexity of applications running today. For those who subscribe to the idea of hundreds or thousands of new “digital workers” entering the labor force, we need to be aware that they will also need a place to work that is safe, spacious and well managed. The difference is that with digital workers those offices or factories will be servers in a cloud. Along with this will come a shift in mindset about IT automation, regarding it not just as a cost center but rather as a more strategic investment. If you want to keep thinking of your IT plant as tactical — and as an operating expense — the IBM solution may be too much for you.

Costs and integration — IBM is offering a portfolio of integrated solutions, and they constitute a high-end offering designed to work better together. Additionally, each IBM product has a lot of depth in its own product category. That said, IBM also charges a premium for these products. When I spoke with IBM executives about this, their feedback was that the competition often lacks the same capabilities or has expensive add-ons to get to the features that enterprises need. I don’t think IBM is wrong here. But, again, if you want a point-solution, IBM may not be where you want to start. By contrast, if you have a clear strategy and want your IT ops team to be maximally effective, IBM should be considered.

Start small but move quickly — Assuming you do choose IBM, also consider a practical and achievable implementation roadmap. IBM itself highlights this approach, because it’s easy to take on more than the organization can handle. Obviously, IBM does have the massive IBM Consulting organization standing by to help, but, based upon my conversations, it’s clear that IBM is considering what else could be done within the products via either new features or educational tools.

As I stated earlier, I feel that a year has made a big difference in IBM’s IT Automation software. And I think IBM gets what it needs to do to attract and satisfy customers. There were many more demos this year. The conversations were frank about how customers are using the technology in the real world. And I heard quite a bit about how much IBM has learned from these acquisitions, suggesting (I hope) that newer acquisitions may go smoother. On that front, I’m excited to see where we stand in another year with HashiCorp — which I’ll be writing more about soon.

Moor Insights & Strategy provides or has provided paid services to technology companies, like all tech industry research and analyst firms. These services include research, analysis, advising, consulting, benchmarking, acquisition matchmaking and video and speaking sponsorships. Of the companies mentioned in this article, Moor Insights & Strategy currently has (or has had) a paid business relationship with IBM.