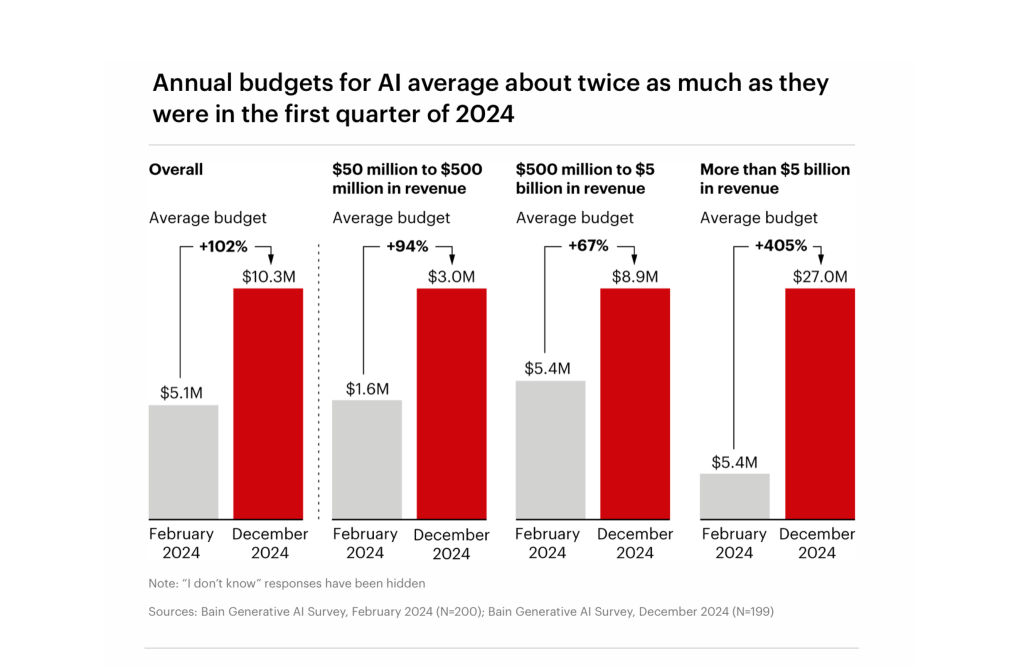

A new survey by Bain & Company has provided a useful picture of both the legal world’s engagement with genAI and that of the wider market. Overall, across all business segments, genAI spending approximately doubled in 2024, going from on average $5.1m to $10.3m in the ten months from February to the end of the year.

At the same time, Bain found that 34% of the legal sector in the US had ‘adopted’ genAI in some way by December 2024. And one can be sure that figure is already higher by May 2025. Plus, it was notably higher than the 2023 level as well.

Moreover, across all businesses where they brought in AI tools for a task around 80% were satisfied that the goals had been met – which is good to see.

And it also found, perhaps as expected, that the sector using AI the most is software development, where numerous stories in the wider press have covered how junior coding roles are being replaced with genAI capabilities. For example, Mark Zuckerberg said this month he’d like to see AI do ‘half of Meta’s coding’ by 2026, which is just seven months away from now.

When you compare all of this with the intentional uptake of the first wave of NLP / ML tools, then it shows a very different picture. Now, some may then say: ‘Legal is only at 34%, while coding is at 60%. Boo…that’s not good.’

But……think back to how few firms were actively using AI tools back in 2016, for example. Now scroll forward to today – which is just two years and six months since ChatGPT launched, and we see an incredible uptake of genAI relatively.

One other point of interest is the level of spending on AI between medium-scale and giant corporations is not that far apart. For example, companies with revenues from $50m to $500m spent around $3m on genAI tools, but far larger ones with revenues of more than $5 billion only spent $27m on average.

One might assume that a $5 billion business would be spending a lot, lot, more, while one can understand a company in the medium-size (relatively) bracket to be spending less.

What does that mean? It suggests that there is a lot more to come in terms of AI use in larger companies as $27m for a $5 billion company is table stakes for such a transformative technology.

Plus, will we see price decreases for AI tools as uptake expands? Based on supply and demand theory then, yes we should.

Overall, this paints a picture of relatively rapid uptake, with legal doing well – and better than the finance sector. And as explored before in AL, as clients change their perception and use of AI, so too does their expectation of what lawyers can do with AI. In turn that means inhouse teams using these tools more, and asking outside counsel to adopt the tech as well.

You can find the full report here.

P.S. HT to Oz Benamram for highlighting the report.

—

Legal Innovators California Conference, San Francisco, June 11 + 12

If you’re interested in the cutting edge of legal AI and innovation – and where we are all heading – then come along to Legal Innovators California, in San Francisco, June 11 and 12, where speakers from the leading law firms, inhouse teams, and tech companies will be sharing their insights and experiences as to what is really happening and where we are all heading.

We already have an incredible roster of companies to hear from. This includes: Legora, Harvey, StructureFlow, Ivo, Flatiron Law Group, PointOne, Centari, LexisNexis, eBrevia, Legatics, Knowable, Draftwise, newcode.AI, Riskaway, Aracor, SimpleClosure and more.

See you all there!

More information and tickets here.