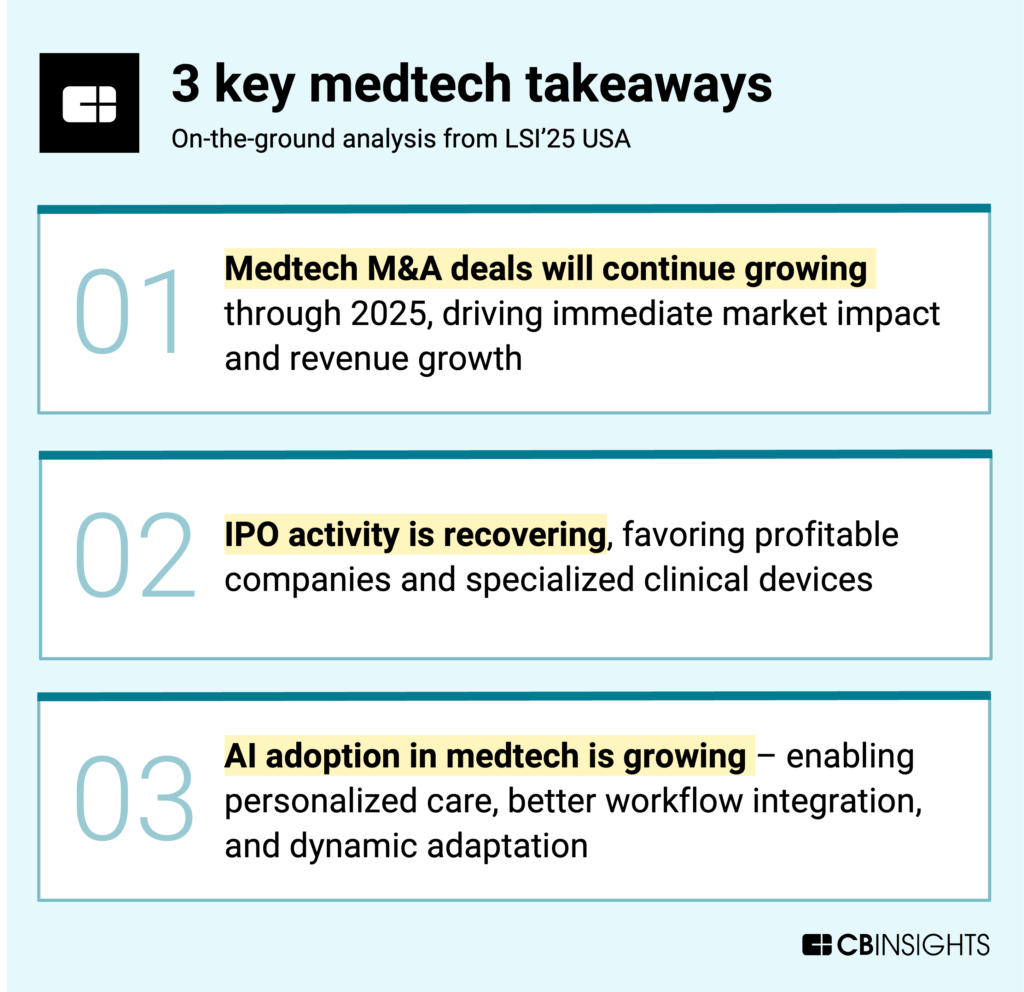

Takeaways from LSI 2025 reveal how the sector is moving toward smarter, de-risked, and AI-enabled growth.

The Life Science Intelligence (LSI) medtech conference took place in March 2025, bringing together entrepreneurs, investors, and other key stakeholders to explore emerging opportunities and innovation across the healthcare ecosystem.

We highlight three pivotal trends from the event — backed by examples and CB Insights data — that capture the sector’s shifting dynamics in 2025.

Medtech giants signal that M&A will remain a key growth driver through 2025

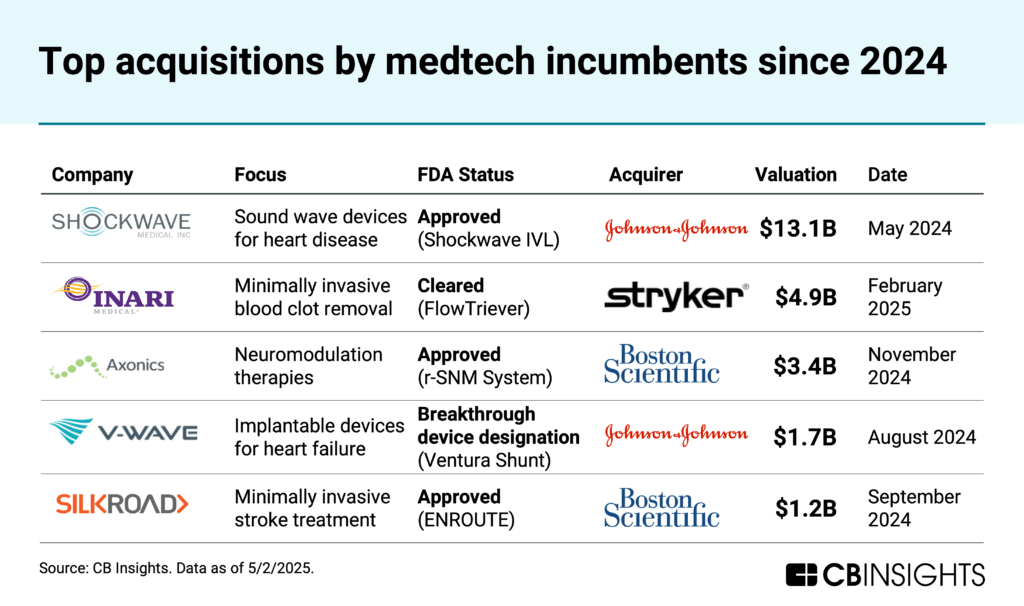

At LSI’25, medtech executives confirmed their commitment to acquisition activities despite ongoing macroeconomic uncertainty. Their outlook reflects the broader rebound in industry dealmaking that accelerated in 2024.

Recent activity from incumbents underscores this trend. Stryker completed 5 deals in 2024 (up from 2 in 2023), culminating in its $4.9B acquisition of blood clot removal device maker Inari Medical in February 2025.

Similarly, Johnson & Johnson increased its deal flow from 0 acquisitions in 2023 to 5 in 2024. Its $13.1B acquisition of Shockwave Medical — which makes devices that use sound waves to break up hardened arterial plaque — marked the largest medtech acquisition since 2022.

After four acquisitions in 2024, Boston Scientific kicked off Q1’25 with two acquisitions that reflect a growing interest in underserved therapeutic areas. In January, it acquired Bolt Medical, a chronic pain device company. In March, it acquired SonVie, which is developing an ultrasound-based therapy for cardiopulmonary hypertension.