From AI agent consolidation to a wave of healthcare AI unicorns, we break down the trends reshaping AI using CB Insights data.

AI funding surged to record levels in Q1’25. And every layer of the AI stack — from horizontal and vertical applications to the underlying infrastructure — is reaping the rewards.

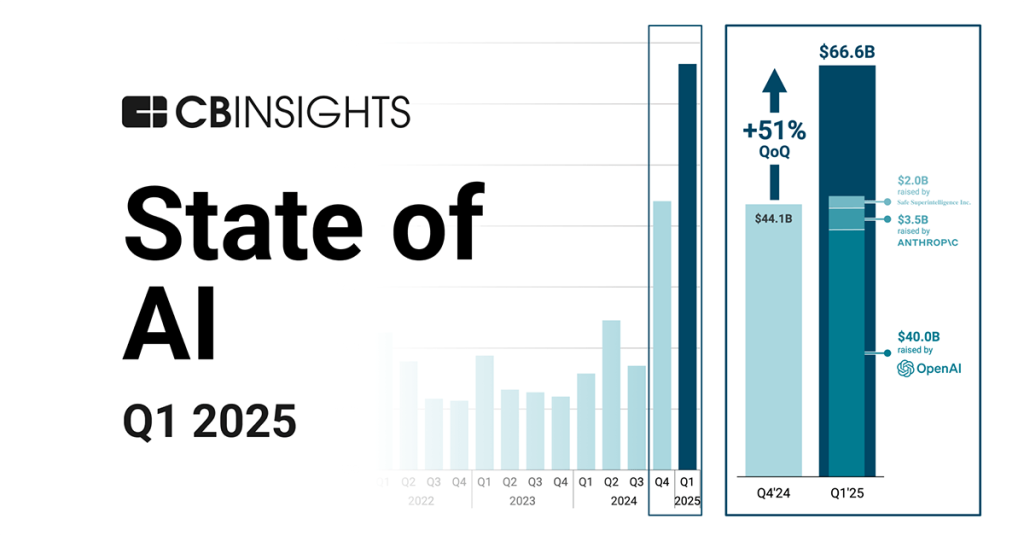

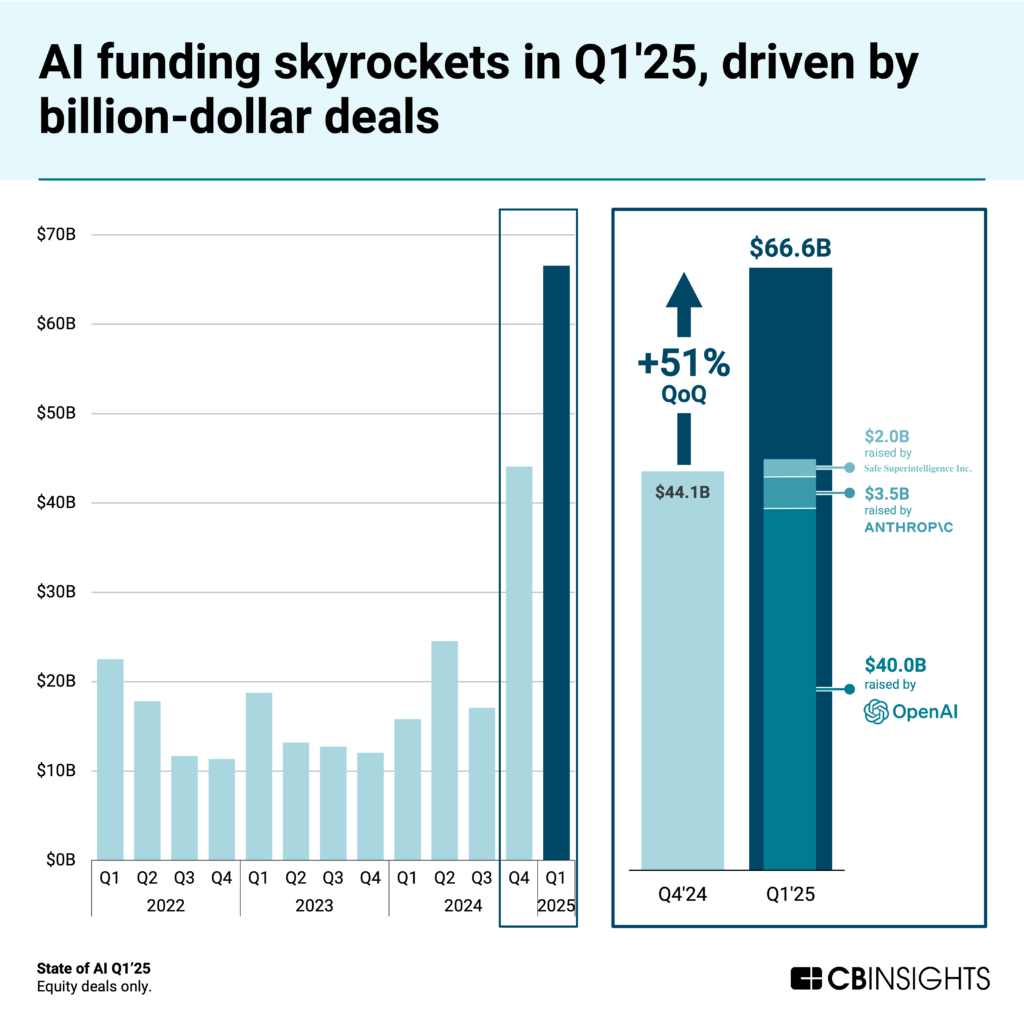

While deal volumes remained mostly steady, funding increased 51% to $66.6B, with the majority of this going to infrastructure companies like OpenAI.

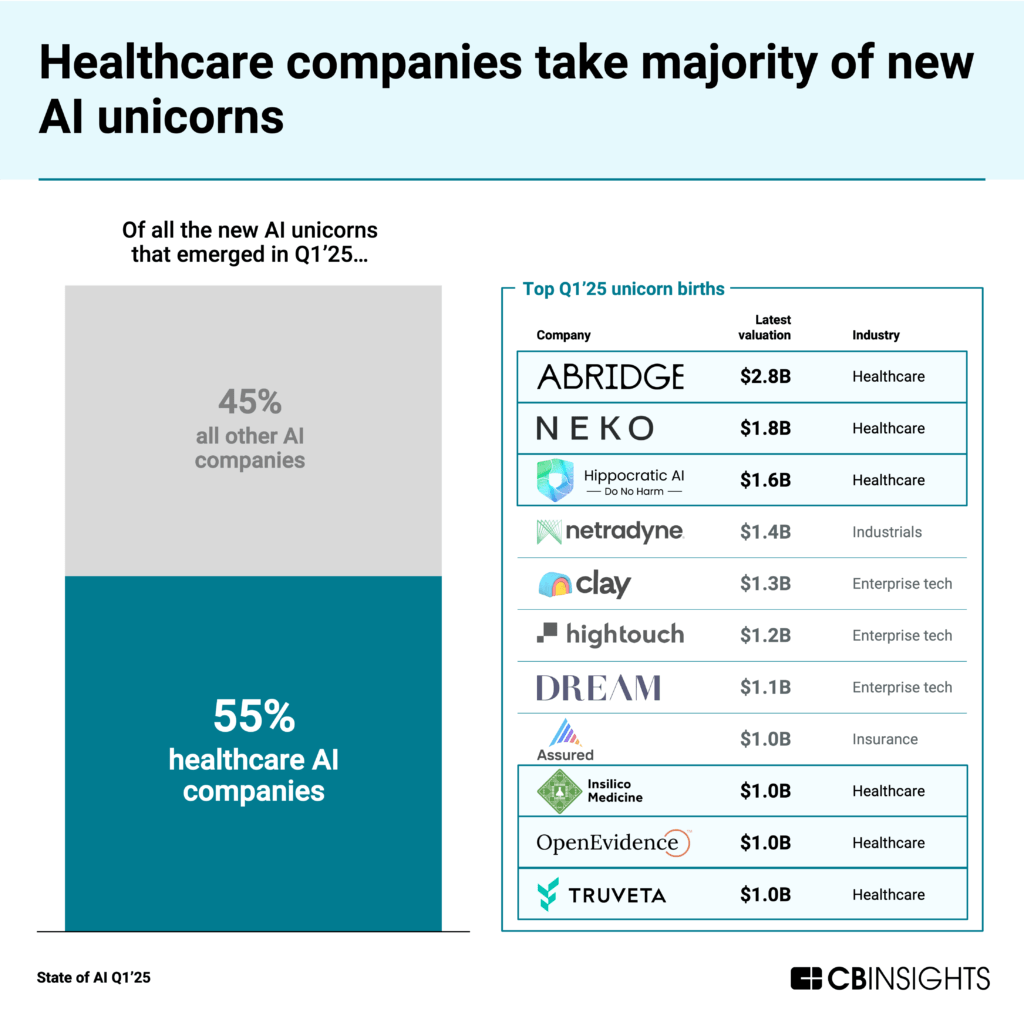

Meanwhile, vertical AI is gaining momentum, with healthcare unicorns dominating Q1’s new unicorn cohort — a sign of investor confidence in AI’s increasing specialization.

Download the full report to access comprehensive data and charts on the evolving state of AI.

Key takeaways from the report include:

AI funding grows 51% QoQ to hit $66.6B — a new quarterly record — as industry incumbents secure mega-rounds. This boost was largely driven by a handful of major infrastructure players like OpenAI ($40B round), Anthropic ($3.5B Series E), and Safe Superintelligence ($2B Series B). Even without OpenAI’s massive round, Q1’25 would still represent the second-highest funding quarter ever (following Q4’24). Deal count decreased only slightly, falling 7% QoQ to 1,134.

Healthcare dominates the new AI unicorn pool. More than half of the 11 AI companies that reached $1B+ valuations in Q1 are developing healthcare solutions. These healthcare AI unicorns made up 30% of all new unicorns across VC and include Hippocratic AI (healthcare models and agents) and Insilico Medicine (AI drug discovery).

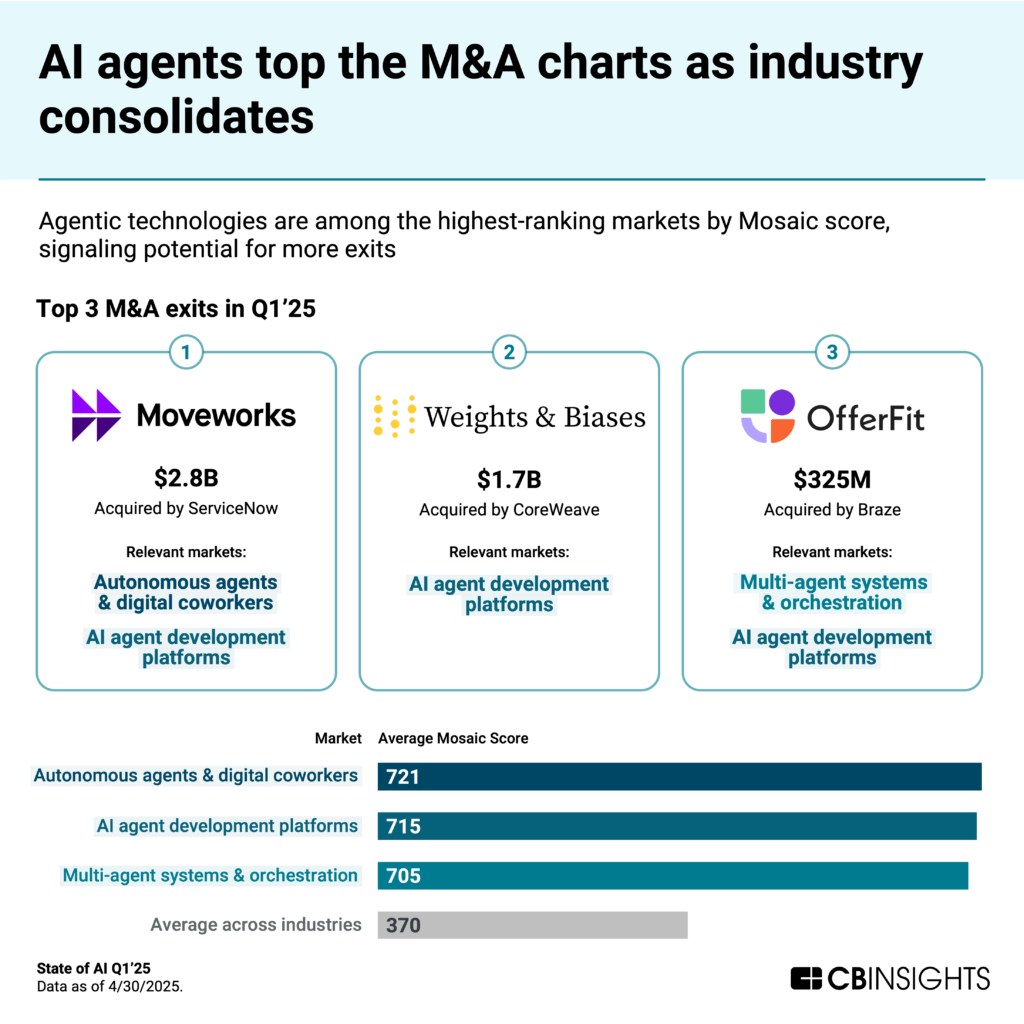

AI agent companies lead M&A activity amid increasing consolidation. The 3 largest of 85 AI acquisitions in Q1’25 went to companies offering enterprise AI agent technology. The markets these companies occupy — like agent developmnt platforms and multi-agent systems — boast among the highest average Mosaic scores across industries, reflecting strong company health and signaling the potential for more exits.

We dive into the trends below.

AI funding reaches record $66.6B in Q1’25 as industry incumbents secure mega-rounds

AI funding grew 51% to $66.6B across 1,134 deals in Q1’25. This quarter’s funding total represents nearly two-thirds of all AI investment in 2024 ($101.5B), suggesting full-year 2025 funding will blow previous years’ tallies out of the water.

The surge was fueled by mega-rounds concentrated among a few infrastructure giants, most notably OpenAI’s massive $40B VC round, along with Anthropic’s $3.5B Series E and Safe Superintelligence’s $2B Series B. Even without OpenAI’s landmark funding round, Q1 would be AI’s second-strongest funding quarter ever.

While total funding surged, the relatively stable deal count suggests larger deal sizes — especially to already established market leaders — rather than simply more companies receiving investment. In fact, in 2025 YTD, the median deal size of $5M represents a 4-year high.

![]() CBI customers: Track 17K+ AI companies

CBI customers: Track 17K+ AI companies

Healthcare dominates the new AI unicorn pool

While infrastructure companies received the lion’s share of funding, healthcare AI players led in new unicorn creation.

Healthcare companies claimed the majority of new AI unicorns in Q1’25, with 6 out of 11 total AI companies reaching the $1B+ milestone. Even when looking at the venture landscape beyond AI, healthcare AI players drove nearly 1 in 3 new unicorn births in Q1.

While healthcare AI unicorns are developing diverse applications across the care continuum, half of these newly minted unicorns apply AI to support provider workflows. These include:

Hippocratic AI (patient follow-up)

Abridge (clinical documentation)

OpenEvidence (healthcare decision-making)

This trend highlights both growing demand for clinician-support tools and strong investor conviction in AI’s ability to deliver returns in the healthcare industry.

![]() See every current AI unicorn

See every current AI unicorn

AI agent companies lead M&A activity amid increasing consolidation

Agentic solutions led the top AI exits in Q1’25, securing the 3 largest deals among 85 acquisitions — establishing agents as the primary focus of industry consolidation.

These acquisitions align with the high Mosaic scores (which measure company health and growth potential on a 0-1,000 scale) across AI agent markets. Top agent categories all score well above the average of 370 across industries: autonomous agents & digital coworkers (721), AI agent development platforms (715), and multi-agent systems & orchestration (705).

The blockbuster exits of companies like Moveworks, Weights & Biases, and OfferFit show that enterprise buyers are increasingly seeking to build comprehensive agent solutions to gain a competitive edge.

![]() See rising markets in the CBI Market Leaderboard

See rising markets in the CBI Market Leaderboard

MORE AI RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.