With valuations, funding rounds, and revenue moving at breakneck speeds, sizing up the market for enterprise AI agents & copilots can be challenging. Mining CB insights data reveals a market worth billions — and one poised for exponential growth.

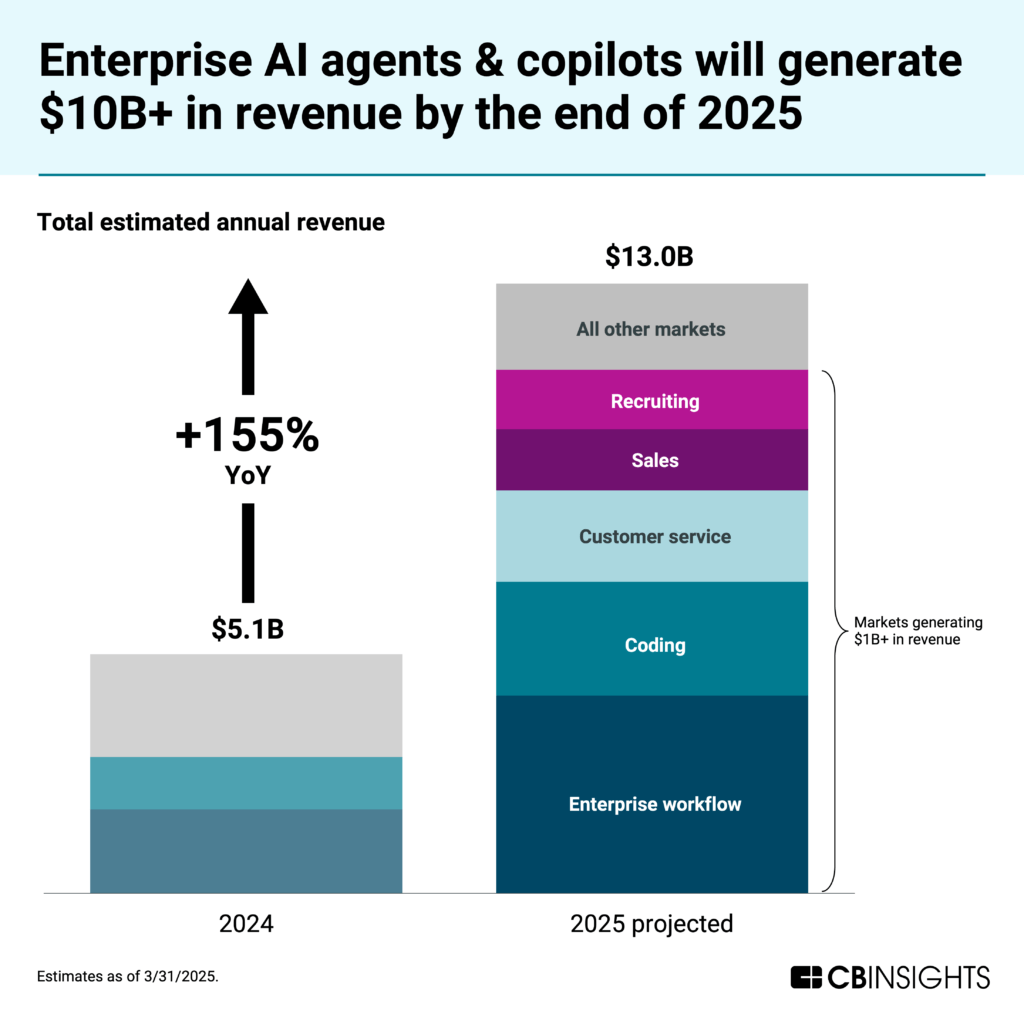

The enterprise AI agents & copilots space is only a couple of years old but already worth $5B and on track to more than double in size this year, according to CB Insights estimates.

These LLM-powered applications can execute complex tasks autonomously (agents) or alongside a human (copilots) and have come for just about every horizontal job function.

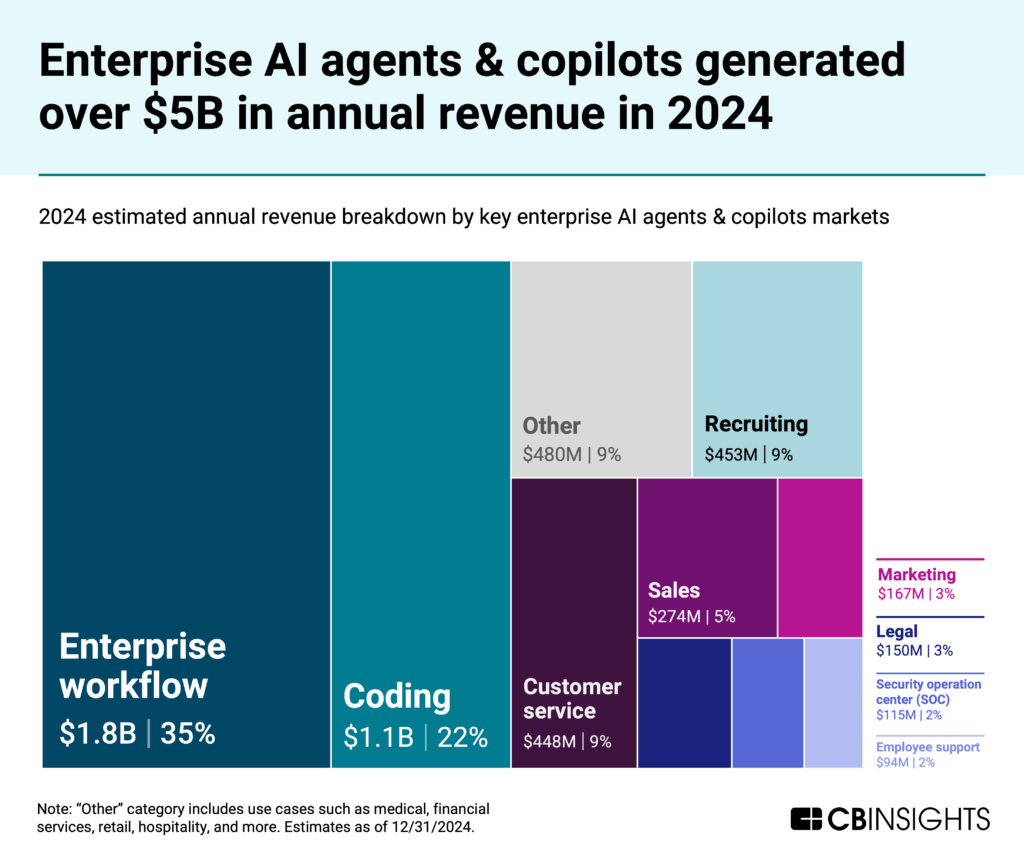

Within the overarching space, 2 markets are already generating over $1B each in annual revenue: enterprise workflow agents & copilots (those targeting a wide range of applications such as general productivity and research use cases) and coding agents & copilots.

Decision-makers need to understand how big the enterprise AI agents & copilots space is and what’s driving it to know where to invest, which product strategy to adopt, and where to focus their AI strategy.

To answer that, we used CB Insights proprietary datasets — including revenue, headcount, valuation, and funding — to create market sizing estimates and predict which enterprise AI agent & copilot markets will grow the most.

Enterprise AI agents & copilots markets featured in this analysis:

Below, we look at the largest enterprise AI agent & copilot developers, how much the space will grow this year, and which markets will drive that growth. We also share the methodology behind our calculations.

Drivers of 2024 revenue growth: Big tech offerings and the rise of AI coding

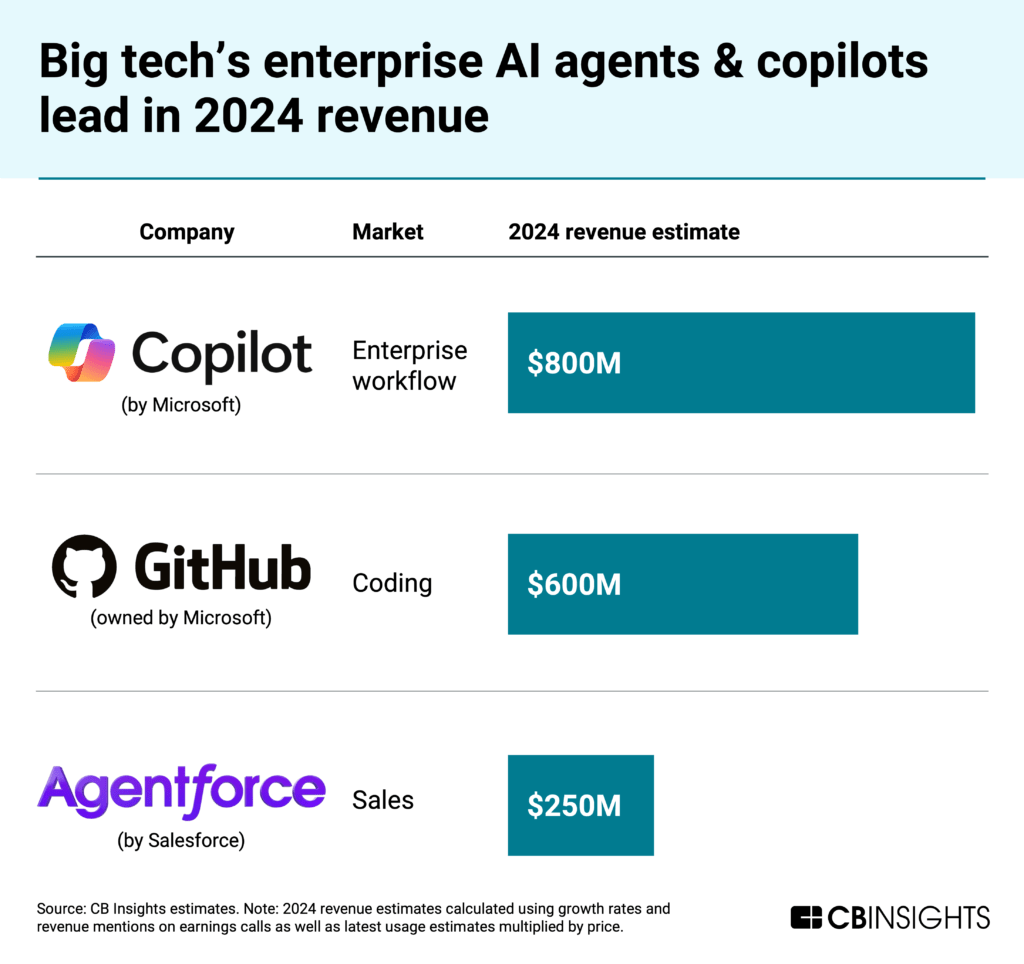

Big tech companies’ offerings made up a third of AI agents & copilots revenue in 2024.

We estimate that Microsoft alone captured 25%+ share of the overall space, led by 2 products:

Microsoft Copilot, with an estimated $800M in 2024 revenue, contributing to enterprise workflow being the top agent & copilot market last year

GitHub Copilot, with an estimated $600M in 2024 revenue

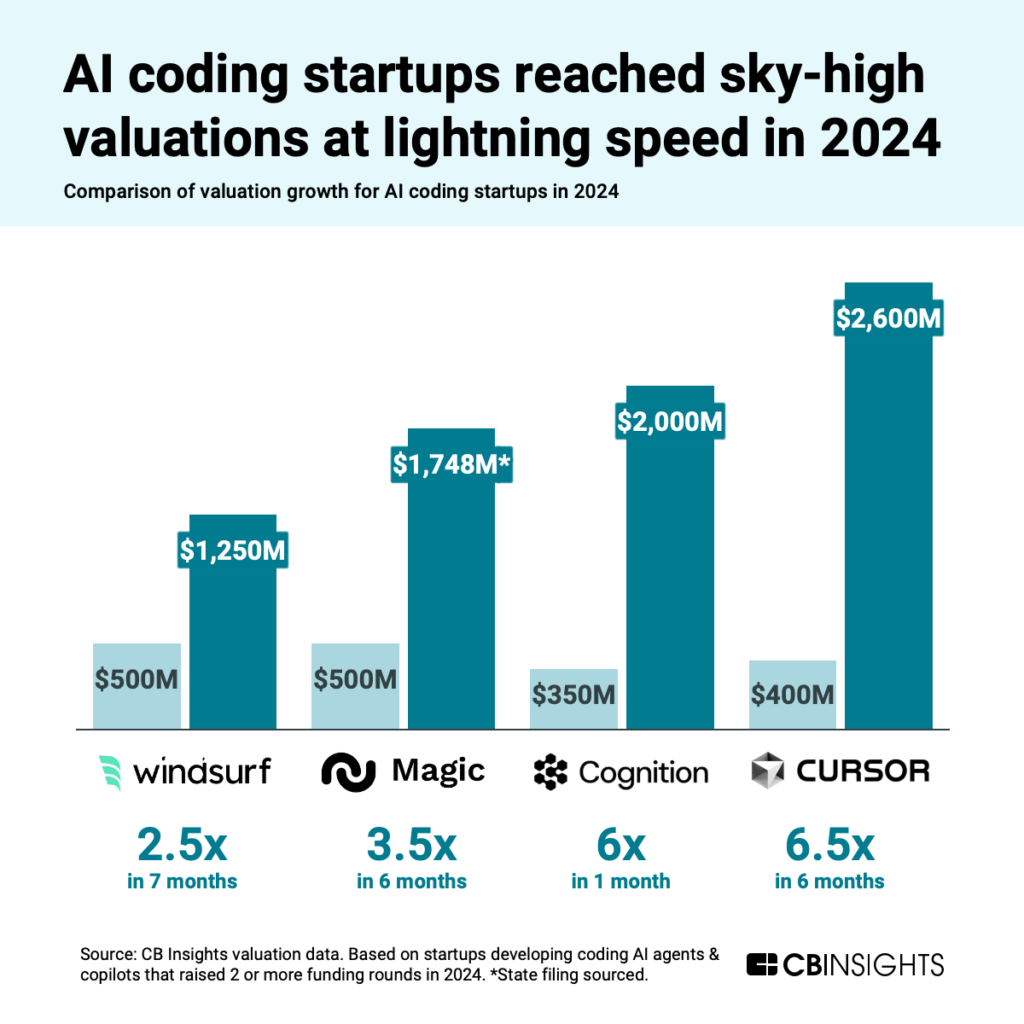

Coding follows enterprise workflow as the second-largest market, with coding AI agents & copilots companies gaining significant traction during the second half of 2024. Already, this space is minting unicorns in as little as 6 months — 4x faster than the AI industry average.

Source: CB Insights — Windsurf company profile, Magic company profile, Cognition company profile, Cursor company profile

Quickly soaring valuations have been supported by explosive revenue growth. StackBlitz‘s Bolt, for instance, grew from 0 to $20M in just 2 months, while Cursor saw ARR increase from $1M to $200M in just over a year.

![]() Rank coding AI agents & copilots by revenue

Rank coding AI agents & copilots by revenue

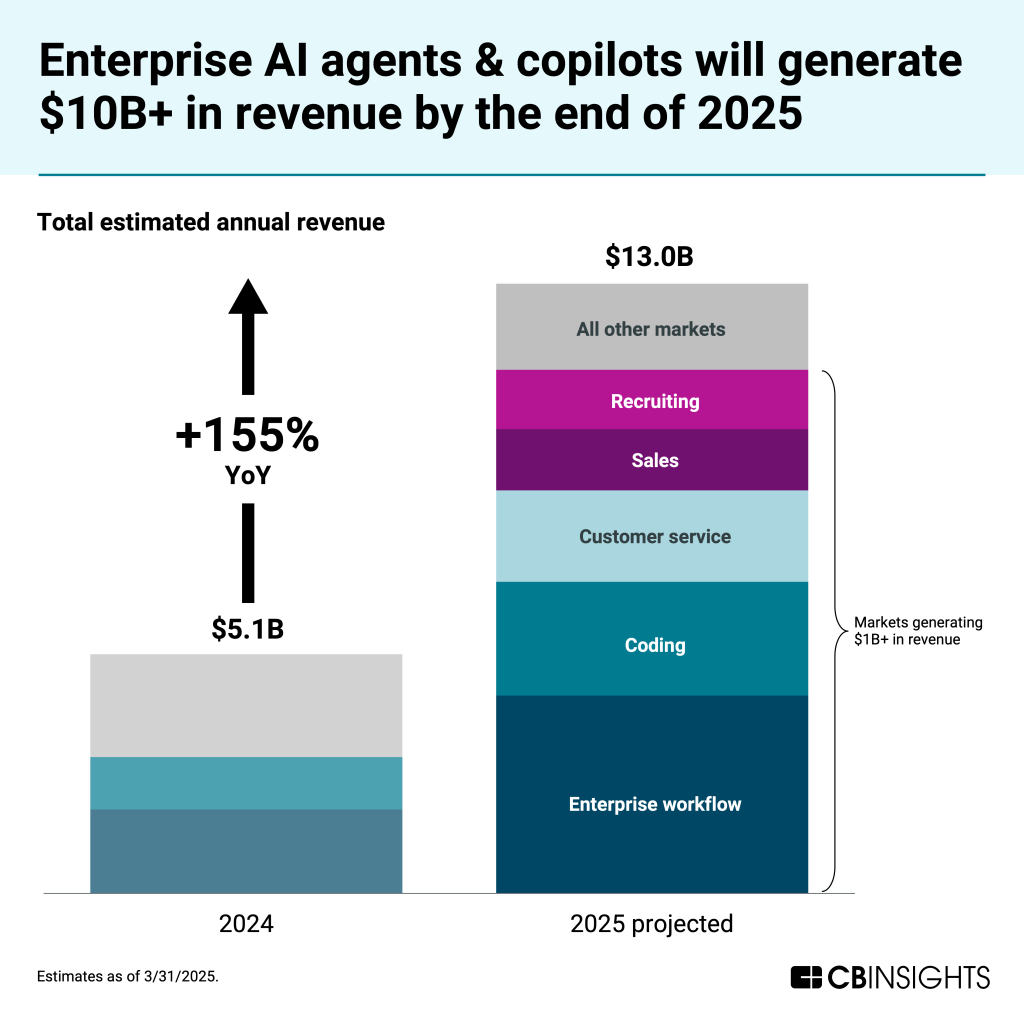

The enterprise AI agents & copilots space will surpass $10B in annual revenue by the end of 2025

The enterprise AI agents & copilots space is showing no signs of slowing down.

Extrapolating on the growth rate observed in Q1’25, we predict the space will grow 150%+ YoY, reaching $13B in annual revenue by the end of 2025.

Fastest-growing markets within enterprise AI agents & copilots in 2025

In addition to enterprise workflow and coding, we expect 3 additional markets will drive growth and generate $1B+ each in annual revenue by the end of the year: recruiting AI agents & copilots, sales AI agents & copilots, and customer service AI agents & copilots.

All 3 markets have experienced 50%+ deal growth over the last 12 months, signaling growing investor interest. (Both the SOC and employee support markets will also experience significant growth this year, although they likely won’t reach the $1B revenue mark given a lower estimated 2024 base compared to the 3 markets mentioned above.)