Findings highlight strategies to drive AI adoption and reshape customer perceptions in insurance

NEW YORK, April 29, 2025 /PRNewswire/ — Genpact (NYSE: G), a global advanced technology services and solutions company, today announced new research uncovering uncertainty around AI adoption within the insurance industry – offering insurers insights to help turn customer skepticism into confidence and preference.

New Genpact study reveals strategies to drive AI adoption and reshape customer perceptions in insurance

Post this

AI in insurance consumer study by Genpact

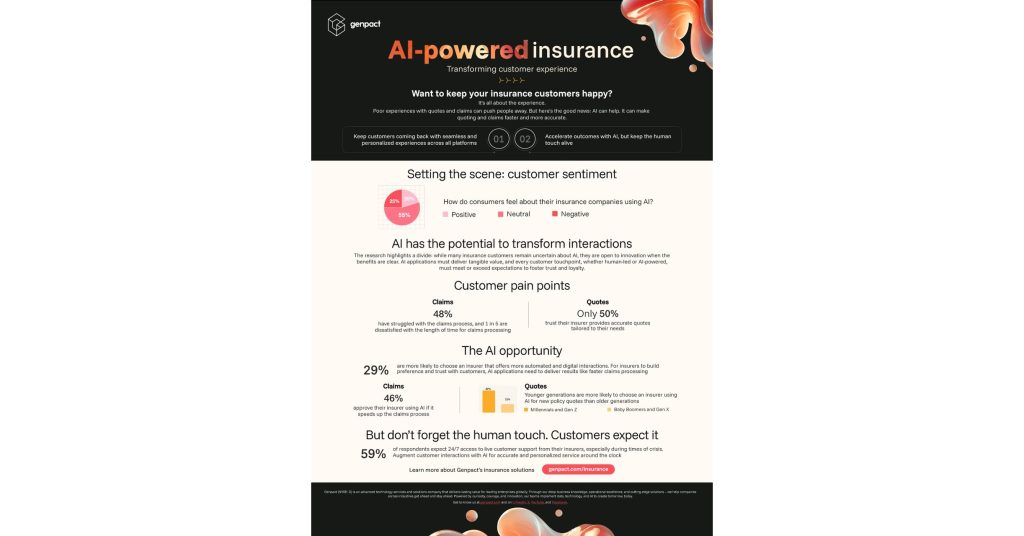

The study reveals that a majority (55%) of US adult respondents feel neutral about their insurance companies using AI, and 25% view it negatively. However, when AI delivers tangible benefits – such as faster and more accurate claims processing, customized quotes, and improved customer service – customer acceptance increases significantly. The findings emphasize an opportunity for insurers to shift perception and build preference and trust with their customers.

“As insurers embrace AI to enhance operations or customer experience, they must ensure that every interaction – whether human-led or AI-powered – meets or exceeds customer expectations,” said Adil Ilyas, Global Business Leader for Insurance at Genpact. “This research highlights AI’s potential to transform insurance, but also the need for insurers to close experience gaps and communicate transparently to build trust and loyalty.”

From indifference to preference: the AI opportunity

The research highlights a complex landscape: while many insurance customers remain uncertain about AI, they are open to innovation when the benefits are clear. Among respondents, 46% support AI adoption if it speeds up the claims process, and 29% are more likely to choose an insurer that offers automated and digital interactions.

This shift in sentiment is especially pronounced among younger generations. Millennials and Gen Z are more likely than Baby Boomers and Gen X to choose an insurer using AI to improve services, including policy quote generation (32% vs. 12%), claims processing (28% vs. 9%), and customer service (27% vs. 10%). This generational divide highlights a growing expectation for faster, more efficient AI-enabled insurance experiences.

Driving value with AI: speed, precision, and a human touch

As digital innovation continues to accelerate, policyholders increasingly expect seamless, personalized interactions. The research uncovers areas that are ripe for AI-driven transformation. Only 50% of respondents currently trust their insurer to provide accurate, tailored quotes, and 48% have struggled with the claims process. AI offers a path forward by automating and streamlining underwriting and claims processing, improving the personalization of new policy quotes and enhancing the accuracy and speed of claims resolutions.

Still, customers aren’t ready to forgo human connection. While 59% of respondents expect 24/7 live customer support, especially during times of crisis, just 10% are comfortable relying solely on AI-powered chatbots. To build customer confidence, insurers must show how AI enhances speed and personalization – while keeping a human in the loop. AI can be a tool for augmenting employees in their roles, automating repetitive, high-volume tasks so they can focus on driving value and improving customer service interactions.

“The integration of AI in insurance is more than a technological shift – it’s a revolution in customer experience,” Ilyas added. “Insurers must align AI strategies with their business goals and customer expectations. Genpact helps insurers harness AI to achieve speed and precision while keeping the human touch central to every interaction.”

Genpact is uniquely positioned to partner with insurers on their AI journeys, offering a blend of deep industry expertise, operational excellence, and advanced technology capabilities. By enabling insurers to unlock the full potential of AI, Genpact drives transformative outcomes and positions its clients for sustained success in a competitive landscape.

See more about Genpact’s work across the insurance industry.

Survey Methodology

This online survey was commissioned by Genpact and conducted by Dynata, a global market research firm, in December 2024. It surveyed 1,000 US adults aged 25 and older to assess perceptions of AI adoption in the insurance industry.

About Genpact

Genpact (NYSE: G) is an advanced technology services and solutions company that delivers lasting value for leading enterprises globally. Through our deep business knowledge, operational excellence, and cutting-edge solutions – we help companies across industries get ahead and stay ahead. Powered by curiosity, courage, and innovation, our teams implement data, technology, and AI to create tomorrow, today.

Get to know us at genpact.com and on LinkedIn, X, YouTube, and Facebook.

MEDIA CONTACT:

Geraldine Lim

Genpact Media Relations

+1-951-318-3494

[email protected]

SOURCE Genpact